Family appraisals are not usually required

Domestic appraisals are a button part of the home buying procedure. An appraisal means that the consumer will pay a good price and you can covers the loan financial up against potential losses.

Although not, home appraisals feels such as for example a burden. They’re an additional cost to your customer and frequently a source off proper care having providers and agents.

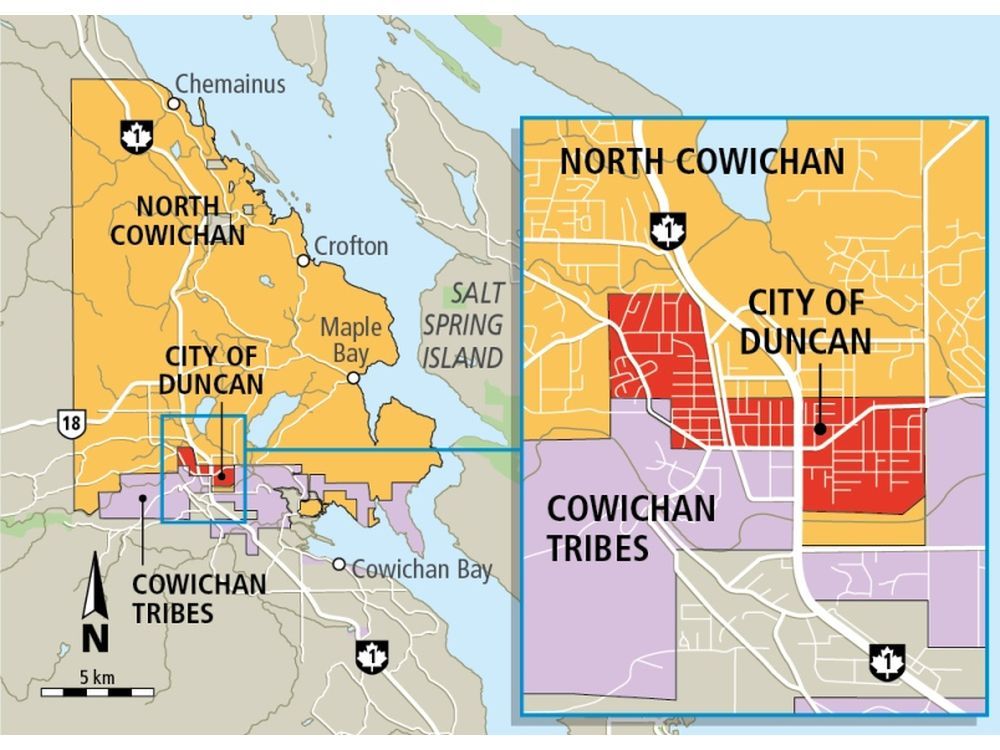

To reduce one burden, a number of bodies firms recently passed a rule stating family appraisals manage no more be needed into residential property attempting to sell to have $400,000 otherwise faster.

Before you could pick up the phone so you’re able to cancel your next assessment, be aware that major lenders will most likely however want them on most conversion process according to the $400,000 endurance. Your best bet to store on will cost you remains to compare rates and pick the quintessential aggressive lender.

But if you have the choice so you can skip property assessment and you may rescue a couple of hundred cash – any time you do so?

Domestic appraisals 101: Gurus, drawbacks, and value

Prior to contemplating whether to opt when you look at the or of a domestic assessment, it is critical to understand what in reality goes on at this stage of the home to get procedure.

Basically, an appraisal verifies the seller has not yet overpriced our home. An expert appraiser commonly search the house, compare the cost with other similar homes in the region, and work out a fair market price examine in order to the brand new sales price.

Appraisals are generally purchased of the customer – and cost are significant. Considering an excellent 2019 research by HomeAdvisor, the typical price range for an assessment is $311-$404.

That said, appraisals plus manage the buyer. (more…)

Read More