38/10

38/10

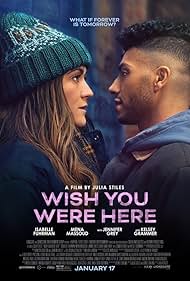

Discover the Magic of “Wish You Were Here” 2025

Are you ready to embark on a journey of love and self-discovery? The highly anticipated film “Wish You Were Here,” directed by a talented newcomer, brings the captivating story of the best-selling novel to life. This warm and romantic film will capture your heart as it explores themes of love, loss, and the pursuit of happiness. Whether you’re a fan of romantic dramas or simply looking for a film that resonates with deep emotional themes, “Wish You Were Here” promises to deliver.

Plot Overview

At the center of “Wish You Were Here” is Charlotte, a woman trapped in the monotony of everyday life. After a magical night with a stranger, Charlotte awakens to find that her perfect moment has vanished. Her journey in search of answers unfolds as she grapples with her disappointments and tries to uncover the truth behind her fleeting experience. The film beautifully depicts her emotional journey and highlights the struggle between desire and reality.

Exploring Themes of Love and Loss

The film delves into the complexities of romantic relationships and the impact of chance encounters. It asks fundamental questions about what it means to truly connect with someone and the sacrifices we make in the name of love. As Charlotte searches for meaning in her life, viewers are invited to reflect on their own experiences of love, loss, and longing for something fulfilling.

Meet the Characters

In “Wish You Were Here,” the narrative is enriched by a diverse cast of characters. Each character brings their own unique perspective to the story, contributing to the film’s exploration of love and relationships. The performances are honest and real, allowing viewers to connect with their struggles and triumphs.

Directorial Debut

With “Wish You Were Here,” a new voice in filmmaking has emerged. The director’s vision for the film is refreshing and moving, demonstrating a deep understanding of the complexities of human emotion. This directorial debut is not just a movie; it’s a call to explore the depths of our desires and the courage it takes to make them come true.

Why You Should See “Wish You Were Here”

This film stands out for several reasons:

- Honest storytelling that will resonate with audiences.

- A captivating exploration of love and self-discovery.

- Powerful performances from a talented cast.

- Beautiful cinematography that heightens emotional depth.

- A journey that connects with you and makes viewers think about their own lives.

If you want to experience a film that blends romance with thought-provoking storytelling, “Wish You Were Here” is a must-see. The emotional depth and relatable characters create a cinematic experience that stays with you long after you check out.

Where to find “Wish You Were Here” 2025

For those who want to watch “Wish You Were Here”, various platforms will offer the movie for streaming. However, if you are considering alternative options, you can explore the option of downloading the movie via torrent. This method can be a convenient way to access movies, especially if you are looking for specific formats or resolutions. When looking for ways to download a movie, remember to prioritize safety and legality. Although torrents can offer a wealth of content, it’s important to ensure you download from reputable sources to avoid potential risks. Always check the legality of the content you want to access and consider supporting the creators by purchasing or streaming through official channels.

Final Thoughts

“Wish You Were Here” is more than a movie; it is an exploration of the human experience. It invites viewers to reflect on their own journeys and the decisions that shape their lives.

Drop 2025 X265 Pluto

Read More

21/17

21/17