1xBet Bonus Offers for New Customer in Zambia

Content

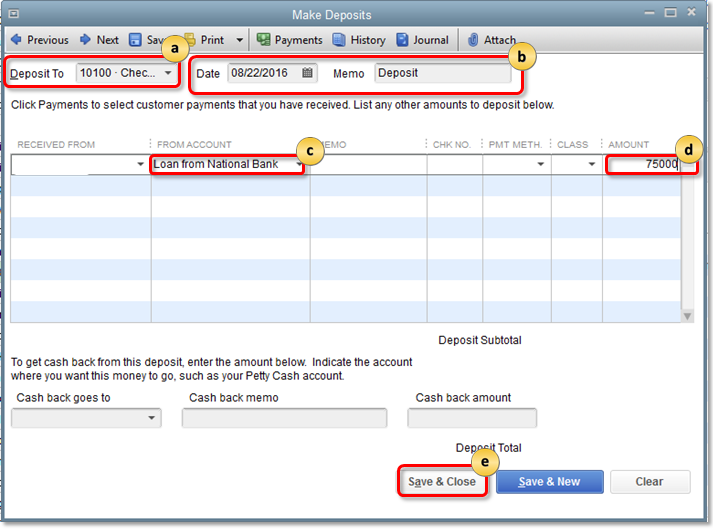

Once the user has agreed to receive the bonus, they can proceed to make a deposit into their account. The amount will be automatically credited to their account after the deposit has been made, and then the funds received can be used. Our experienced authorsadvise betting on the hottest events, a list of which can be found on the main page of the bookmaker.

The validity period of 1xBet sports bonuses ranges from one day to 30 days, depending on the specific type of bonus. This website is using a security service to protect itself from online attacks. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. The 1xBet bonus code is a distinctive combination of numbers and/or letters that serves as an activation key for specific bonuses. If a bonus isn’t activated automatically, kindly contact the platform’s support service for assistance in activating it.

- I would encourage other 1xBet players to try their best and not to give up.

- “I was so excited I couldn’t believe that out of all those participants I came out on top.

- However, there are a few terms and conditions you should take note of before claiming this bonus.

- To avoid losing everything, set a limit for yourself and do not exceed it under any circumstances.

It’s important to note that if the first eligible bet is a winner or not a single Correct Score bet, the free bet will not be credited. By the way, your bets can win much more often if you look at our predictions football page more often. This promo gives you the chance to claim different promotional tickets by betting on the UEFA Champions League events. The more tickets you get gives you more chances to win fantastic prizes in the draws. Sports betting can bring you the joy of winning and a solid income if you do not forget the 7 rules of responsible gambling from a reliable bookmaker 1xBet.

Smart Driver of the Month: a program that changed the driving culture in Zambia

However, there are a few terms and conditions you should take note of before claiming this bonus. It’s important to note that the start dates of all the events included in the accumulator bets must not be later than the validity period of this offer. Users should ensure that their bets comply with these requirements in order to fully enjoy the benefits of the first deposit bonus from 1xBet. 1xBet provides a first deposit offer to its users, allowing them to receive a bonus of up to 6300 ZMW. To qualify for this bonus, the minimum deposit required is 15 ZMW. In order to receive the bonus, the user must agree to it in the My Account section.

You are unable to access gsb.co.zm

Social media contests are one of the features 1xBet players like. In this kind of sporting betting customers don’t risk their money, but they can test their intuition and get to know other sports betting enthusiasts. The 1xBet No-Risk Bet promotion offers an exciting opportunity for bettors to wager on selected events without the fear of losing their money. On the dedicated promotion page, users can explore a range of events where they can place bets without the risk of financial loss. This bonus is eligible to only users who deposit with MTN Mobile Money in Zambia and offers you a 10% cashback bonus in form of a promo code on your losses.

“We regularly hold promos of this kind for big matches and tournaments. It is nice that players have an opportunity to get new bright emotions and win with their favorite teams,” said a 1xBet representative. The 1xBet bonus can be utilized for betting on a diverse selection of sports, such as football, basketball, and more. The 1xBet bonuses are accessible to users who have registered on the platform. To fully utilize the bonus, the user must wager the bonus amount five times by placing accumulator bets.

While the bonuses themselves do not require direct payment, they necessitate deposits to activate. The most surprising thing is that this was the first 1xBet promo that the player participated in. Our football tips are made by professionals, but this does not guarantee a profit for you.

The 1xBet mobile app offers the same functionalities as the web version, enabling you to effortlessly activate and enjoy the bonuses. Charles’ success is proof that you don’t have to be a super-experienced player to win. In the 1xBet post comments, users have to answer the question of how many matches Kabwe Warriors FC played this season.

How Do I Claim the Lucky League Bonus?

1xBet is not one of https://1win-casino-az.net/ the new bookmakers online, so the company can offer a balanced bonus packer for every gambler. No matter how much money you have, 1xBet ensures that its bonuses are suitable for all types of users. A notable feature that makes 1xBet’s betting bonuses appealing is the availability of promo codes. These codes serve as special keys that unlock exclusive bonuses surpassing the regular offers. Promo codes often reveal highly profitable rewards like free bets, enabling users to place wagers without using their own money.

The credited free bet will appear in the user’s account as a promo code. Please note that the bonus will only be credited to your account within the next 24 hours after the bet has been settled. If a bet placed through this promotion happens to lose, the bettor will receive a free bet equivalent to the stake amount lost, up to the maximum free bet limit.

Please familiarise yourself with the rules for better information.

In any sport, there are situations when the clear favorite loses, and the most incredible outcome turns out to be an irreversible reality. It is not worth playing to the last penny – especially if you have been saving to pay for an apartment, school or food. To avoid losing everything, set a limit for yourself and do not exceed it under any circumstances.

There are many excellent bookmakers in our list betting sites, but 1xBet really stands out even among the best. The company offers a wide range of events and betting markets and rewards its players with incredibly lucrative bonuses. In general, the sportsbook can be considered the flagship of betting services in Zambia, which attracts gamblers with excellent sports betting opportunities.

Step 3. Navigate to the Promo Code Section

The Champions League final between Real Madrid and Borussia Dortmund attracted the attention of millions of fans worldwide. That’s why, especially for the final game, the reliable betting company 1xBet held a promo on its social networks involving thousands of sporting betting fans. 1xBet bonuses operate as complimentary bets, granting you additional chances to place wagers and potentially enhance your winnings.

By following these guidelines, you can increase the likelihood of resolving the access issue and once again enjoy the 1xBet platform. “I was so excited I couldn’t believe that out of all those participants I came out on top. I would encourage other 1xBet players to try their best and not to give up.

Additionally, at least three of the events included in these bets must have odds of 1.40 or higher. Even if you’re a beginner in the world of betting, it’s easy to grasp and utilize bonus codes. We have outlined a series of uncomplicated steps to assist you in redeeming them correctly. Simply follow these clear instructions to navigate the process seamlessly. If the problem persists despite these steps, don’t hesitate to contact 1xBet’s customer support for further assistance.

It is your choice whether or not to participate in the promotion, and you can opt out of any sportsbook bonuses. Sometimes, like many other online betting sites, 1xBet may experience temporary unavailability for its players. If you’re encountering difficulties accessing the bookmaker’s website, there’s no need to worry. There are troubleshooting steps you can take to address the problem and potentially regain access to the 1xBet Zambia platform.

Read More

45/49

45/49

16/31

16/31