37/26

37/26

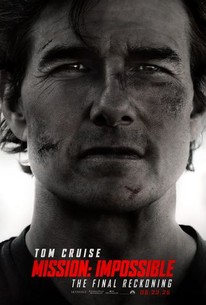

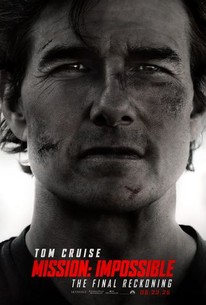

Missão: Impossível – O Reckoning Final: Uma Visão Geral

Missão: Impossível – O Reckoning Final é outra emocionante parcela da lendária franquia que cativou o público por décadas. Este filme continua a saga do agente do FMI Ethan Hunt, conhecido por sua determinação inabalável e habilidades extraordinárias. A narrativa é cheia de suspense, acrobacias de tirar o fôlego e reviravoltas inesperadas, então os fãs da série não ficarão desapontados.

História

Em “Missão: Impossível – O Reckoning Final”, Ethan Hunt enfrenta seu maior desafio até agora. Com a segurança global em jogo, surge uma nova ameaça que pode desestabilizar nações inteiras. Desta vez, Hunt deve navegar em uma teia de engano e traição enquanto velhos aliados se tornam novos inimigos. O filme começa com Hunt recebendo um briefing secreto da missão que revela a existência de uma nova arma poderosa capaz de causar destruição catastrófica. A equipe do FMI tem a tarefa de encontrar essa arma antes que ela caia nas mãos erradas. No entanto, à medida que se aprofundam na investigação, eles descobrem uma conspiração que atinge os mais altos níveis de poder. À medida que as apostas aumentam, Hunt deve contar com sua equipe, antiga e nova, para impedir o desastre iminente. Conforme o tempo se esgota, a equipe embarca em uma aventura cheia de sequências de ação em ritmo acelerado, espionagem e reviravoltas intrincadas que mantêm os espectadores fisgados.

Personagens principais

O filme apresenta um elenco de estrelas, com rostos familiares reprisando seus papéis, bem como alguns recém-chegados que trazem uma nova dinâmica à história. Aqui está uma rápida visão geral dos personagens principais:

| Personagem |

Ator |

| Ethan Hunt |

TBD |

| Luther Stickell |

TBD |

| Ilsa Faust |

TBD |

| Novo personagem |

TBD |

Sequências de ação em ritmo acelerado

Uma das marcas registradas da série “Missão: Impossível” é seu comprometimento com sequências de ação de cair o queixo. “The Final Reckoning” eleva o nível ainda mais alto com uma série de cenas espetaculares que mostram a fisicalidade e a habilidade do elenco. De perseguições em telhados a perseguições de carro em alta velocidade, cada cena é cuidadosamente projetada para criar uma descarga de adrenalina.

Acrobacias e efeitos especiais

A equipe de produção do filme se esforçou muito para garantir que as acrobacias fossem o mais realistas possível. Muitas das sequências de ação são realizadas sem a ajuda de CGI, permitindo que os espectadores apreciem o talento e a coragem dos atores. Acrobacias notáveis incluem:

- Escalada vertical em uma parede de um arranha-céu.

- Combate de helicóptero duvidoso.

- Sequências intensas de combate corpo a corpo.

- Perseguições explosivas por ruas lotadas.

Elementos temáticos

Além da ação, Missão: Impossível – O Reckoning Final lida com temas mais profundos, como confiança, lealdade e as complexidades morais da espionagem. Enquanto Hunt lida com as consequências de suas ações e as escolhas daqueles ao seu redor, os espectadores são convidados a refletir sobre o que significa ser um herói em um mundo cheio de áreas cinzentas.

Recepção da crítica

Embora o filme ainda não tenha sido lançado, os primeiros rumores sugerem que The Final Reckoning será um sucesso entre os críticos e fãs. A franquia tem sido consistentemente elogiada por sua narrativa envolvente, desenvolvimento de personagens e sequências de ação inovadoras. As expectativas para esta parcela são altas, especialmente porque promete resolver histórias em andamento ao introduzir novos elementos.

LIVES LIVES BURDEN MULTI

Read More

37/26

37/26

42/38

42/38