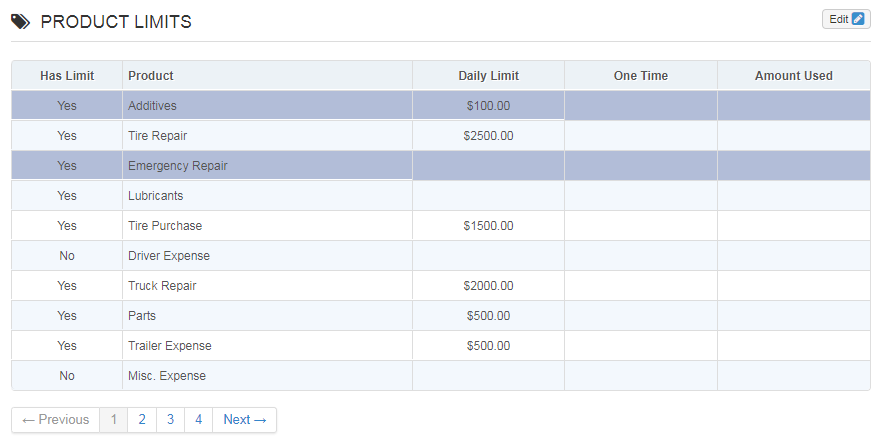

If you are looking to own good ?30,000 mortgage, your monthly money could well be higher or all the way down according to rate of interest, their put, as well as the length of the financial, once we have put down a rough illustration of less than.

These types of rates would be to only be managed as a guide rather than mortgage information. Data derive from a fees home loan, maybe not a destination simply mortgage and you may determined with Currency Guidance Service’s financial calculator.

Give yourself time for you develop an effective credit score and if the profits was secure otherwise growing year towards 12 months for the the levels just be within the a good stead

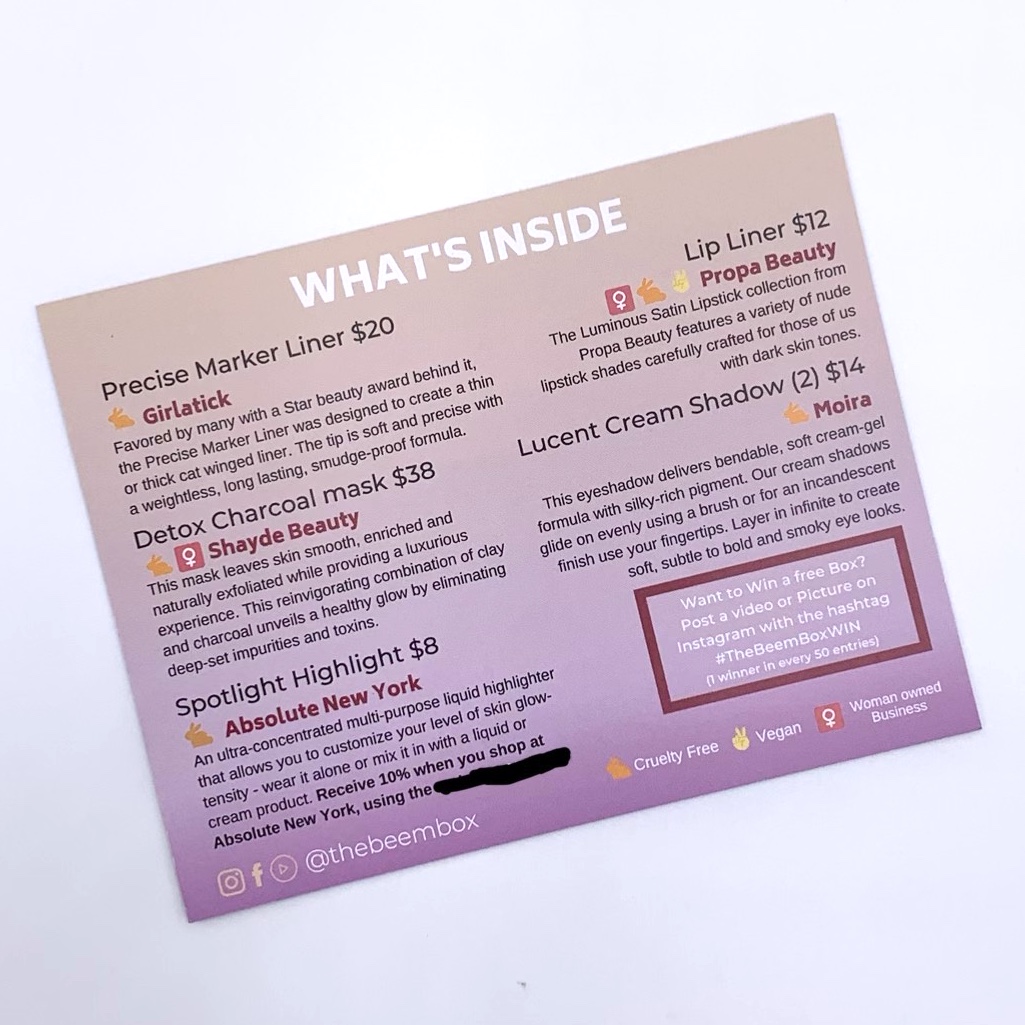

Loan providers fundamentally render mortgage loans to the people that will offer the very least put out-of ten%. But not, particular lenders will accept a deposit as little as 5%, equating to ?step 1,500, while some could possibly get prefer an effective fifteen% put, totalling ?cuatro,500.

Your first put would be one of several products you to apply to whether or not you really can afford a good ?30,000 financial. This, and due to the fact general cost of your own monthly payments plus the court charges which you yourself can need to pay whenever securing your house usually all the feed into the choice away from affording the mortgage.

You need to calculate their month-to-month paycheck, account fully for typical outgoings that you have and you can contrast so it on the predict monthly obligations, considering mortgage terms and conditions and you will rates. The available choices of a mortgage may also believe the credit records. (more…)

Read More