These types of funds come with financing charges that will vary from the mortgage form of and you will experienced updates

Editor’s note: This will be one in a series of pieces that comprise the new Army Minutes 2018 Positives Book. Realize otherwise obtain the whole elizabeth-guide right here.

Related

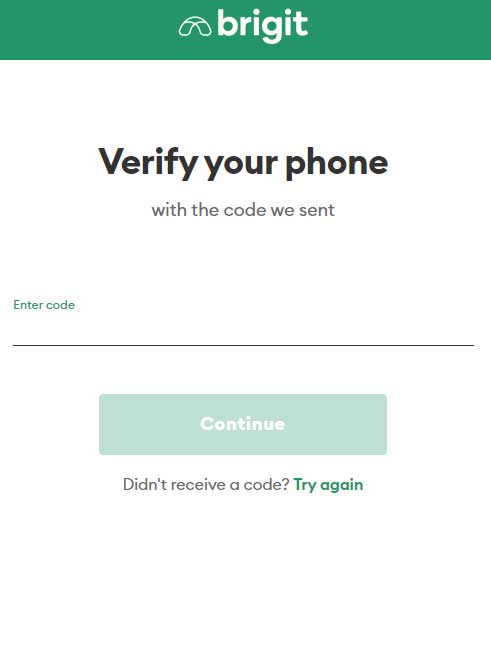

Prepared to take the plunge to your owning a home? Let me reveal some history towards Va financing system, and this took profile near the end of World war ii and you may has been utilized because of the millions of services participants and you can veterans as the then: Almost step three billion provides Va-supported finance right now, and most 740,000 funds was indeed applied for inside the fiscal 2017.

What it is: The fresh Veterans Affairs Agency pledges a share off an eligible beneficiaries home-buy or domestic-refinance mortgage, making it possible for the lending company to provide a whole lot more beneficial terminology and regularly permitting the new borrower make bargain instead of a down payment.

- Home-buy financing toward attributes to $424,000 – a great deal more in some high-rates section. These could be employed to buy are created belongings or homes less than build, oftentimes, although not cellular land.

- Cash-away refinance finance, whether or not the original loan is actually Va-backed.

- An interest rate Cures Home mortgage refinance loan, to minimize the speed into the a current Virtual assistant-supported financing.

Pros by using the benefit the very first time towards a zero-down-commission get mortgage spend a 2.15 per cent commission, instance, when you find yourself a seasoned and work out a second cash-aside refinance mortgage carry out spend 3.step 3 %. An entire commission table exists right here (PDF).

Almost every other financing, as well as shared financing, framework financing and finance to cover will set you back of your time-productive solutions, can also getting supported by Va. (more…)

Read More