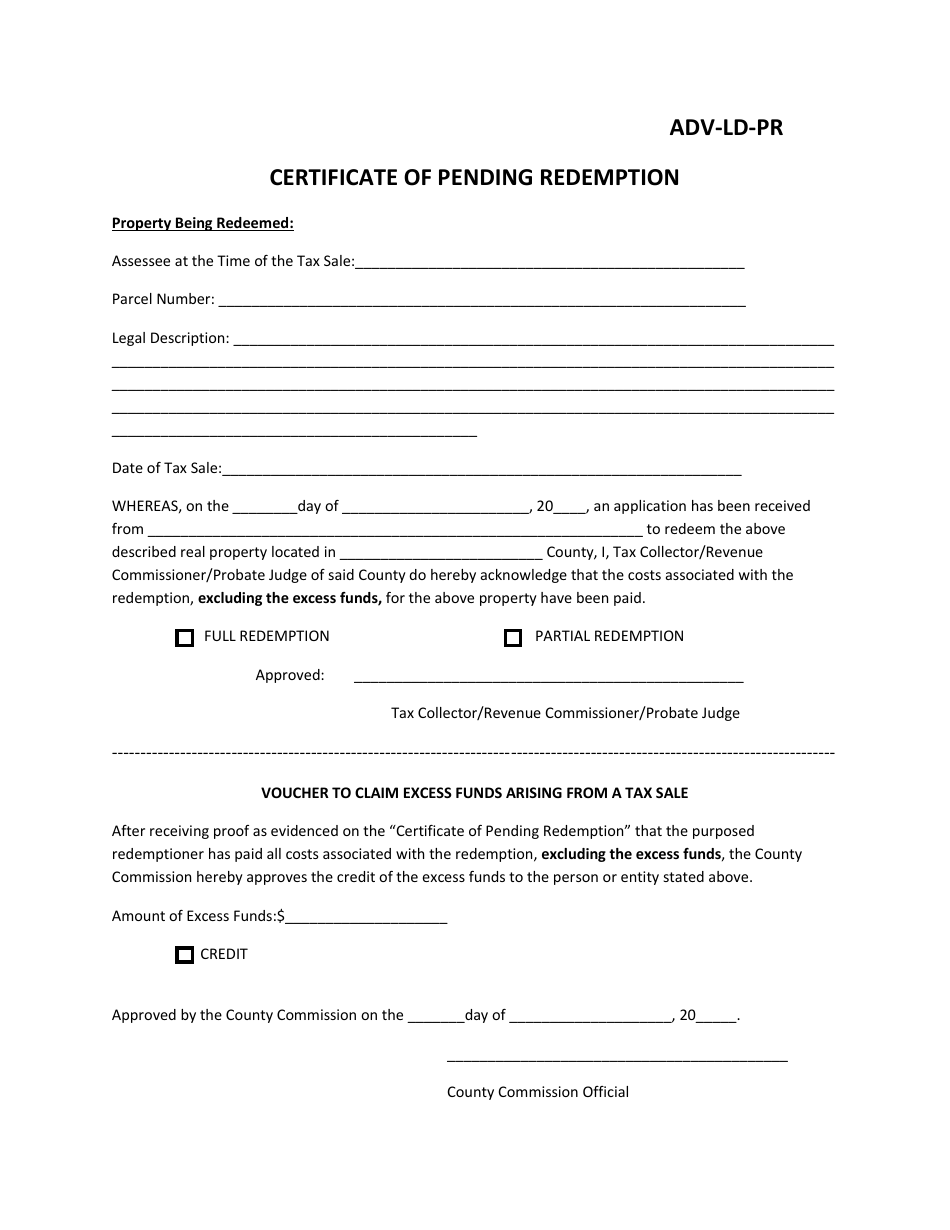

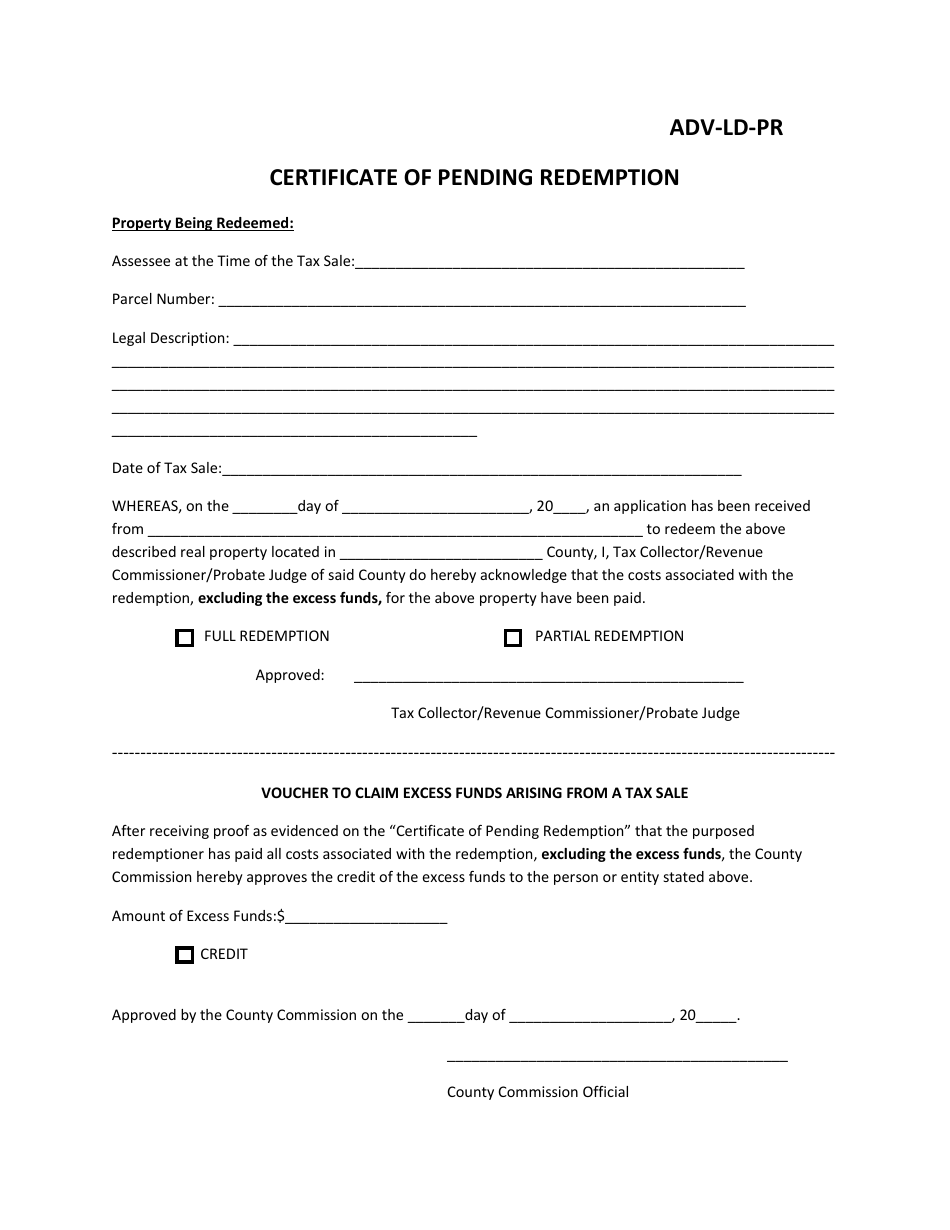

Use starting with Php 25,000 monthly money

Your loved ones fantasy home now made reasonable and you will inside your arrived at having lower down-payment and prolonged commission conditions. And, secure attract rebates after you shell out timely.

Automated debit plan

Register for automatic debit plan to possess worry-totally free money. It is possible to pay online, through GCash or within BPI commission locations.

Earn 2% notice rebates

Pay punctually and possess 2% discount to the attract payments every year till the prevent of one’s term provided that brand new debtor has no later payments from inside the mortgage wedding.

step three. Every land, leaving out unused loads, are permitted; but not, simply for a max collateral well worth (we.e. Overall Bargain Speed otherwise Full Appraised* Value) from Php step three,five-hundred,000 simply.

*at the mercy of new bank’s normal assets appraisal parameters

cuatro. The maximum (or minimal) deductible loan amount try Php 3,325,000 (or Php300,000) while the restriction (otherwise minimum) repayment term is actually 29 (otherwise 1) year/s.

5. The customer should get a 2% discount on the appeal costs annually until the stop of your own title so long as brand new debtor doesn’t have later money inside financing wedding.

step one. The fresh new MyBahay program is offered to the accredited somebody, no less than 21 y/o abreast of loan application and not more 70 y/o up on loan readiness.

step 3. All of the characteristics, excluding empty plenty, are allowed; yet not, limited by an optimum collateral value (i.elizabeth. Total Bargain Speed or Overall Appraised* Value) away from Php 3,five-hundred,000 simply. (more…)

Read More