Your loan term including can not be three to five months unless the full payment will not exceed the greater amount of out of (i) 5.0% of your own confirmed terrible monthly money or (ii) 6.0% of one’s confirmed websites month-to-month income. Your automobile title financing was repayable when you look at the considerably equivalent monthly premiums from prominent, fees, and notice shared.

Make sure to read the entire financing agreement very carefully before signing and dating they

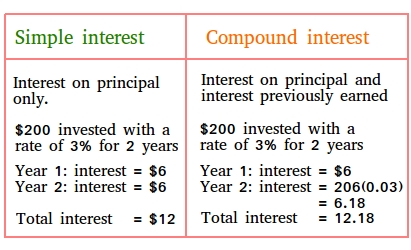

Attention, Charges, and you may Costs: A car or truck title bank was permitted to charge you (i) attention at a straightforward annual rates not to go beyond 36%; and (ii) a monthly repairs payment that does not surpass brand new lower off $15 otherwise 8.0% of your own to begin with contracted amount borrowed, provided the maintenance fee is not added to the loan harmony on which attention is energized. As well as attract as well as the month-to-month fix payment, an auto title financial may charge your a deposit item go back fee with the actual amount incurred of the motor vehicle title financial, not to meet or exceed $twenty five, if the view or electronic percentage are came back delinquent since the membership on what it was pulled are signed from you or contained diminished funds, or if you eliminated payment personal loans for bad credit Utah on the evaluate otherwise digital commission. (more…)

Read More